The S&P Global Clean Energy Transition Index, a key benchmark for clean-energy companies, has dropped by 16 per cent over the past year, despite the so-called “green” transition and strong backing from government and media.

The S&P index, which tracks green energy companies in developed as well as emerging markets, had soared during the Covid-19 pandemic.

Since then, though, momentum has faded, wiping out all gains from the past five years.

“Valuations are at extremely low levels,” Handelsbanken’s portfolio manager Patric Lindqvist told Swedish economic magazine Affärsvärlden on March 21.

“This is partly due to de-globalisation and political shifts, which have meant that there has been great uncertainty.”

Lindqvist also noted the slow pace of implementing regulations that were meant to accelerate climate solutions.

Until recently, environmental, social and governance (ESG) criteria were seen as a “golden ticket” for investors, promising both profitability and a feel-good factor of supporting sustainability.

Green stocks, tied to renewable energy, electric vehicles and eco-friendly innovations, rode a wave of optimism and attracted a lot of cash.

Now, though, the tide has turned.

Rising interest rates, inflationary pressures and a global shift toward energy security over ideology have hammered those sectors.

Solar and wind companies have been facing supply-chain woes and higher costs, while electric-vehicle stocks grappled with softening demand and fierce competition, in particular from China.

Major ESG-focused funds have underperformed broader market indices in recent quarters, with some “green darlings” including hydrogen fuel-cell makers and small-cap clean-tech firms seeing share prices collapse by double digits.

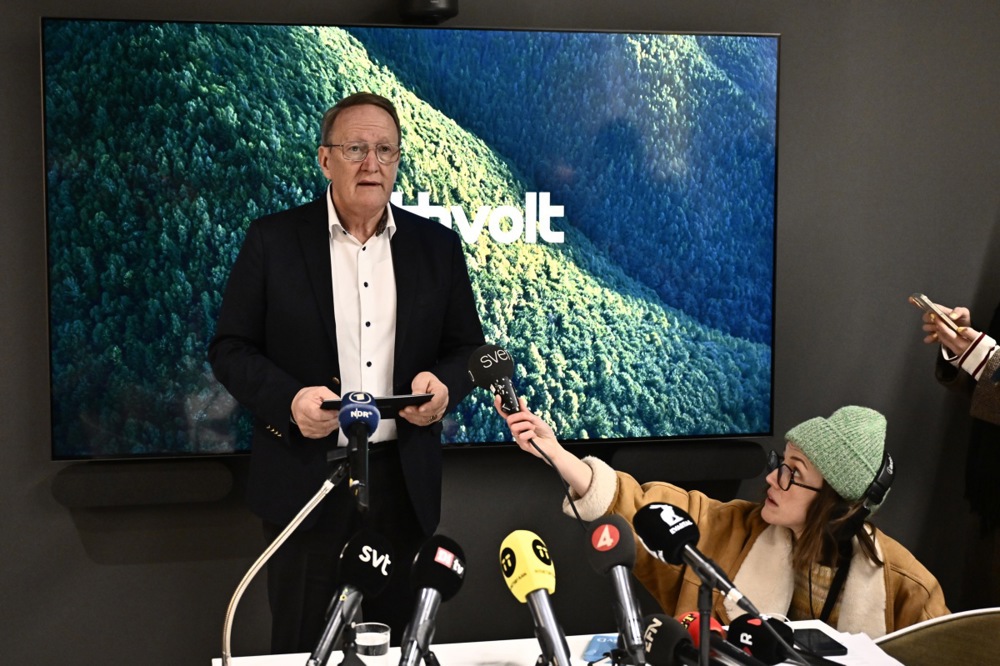

Swedish electric battery battery maker Northvolt has filed for bankruptcy in Sweden after it was unable to find money to pay its taxes. https://t.co/Al2OcIcCpR

— Brussels Signal (@brusselssignal) March 13, 2025

Despite that, Lindqvist remained positive. “The degree of maturity among the technologies for solving the climate crisis is significantly greater now than five years ago, and thus the technology risks today are somewhat lower,” he said.

Deirdre Cooper, head of sustainable equity at global investment manager Ninety One, told the Financial Times on March 16 that pessimism hanging over the decarbonisation sector was “exceptional” and mismatched with underlying company performance.

“Companies that we hold in the decarbonisation sector have seen strong growth and stable returns, but they have underperformed in terms of share price,” she said.

“I have never seen such bearishness in terms of the valuation for companies with structural growth … The market is assuming no growth for decarbonisation.”

A day later, the FT reported that Aviva Investors, a division of French insurance giant Aviva, had revised its plans to divest from companies that, in its assessment, were not making sufficient efforts to decarbonise.

A significant amount of government funding originally allocated for Covid pandemic relief and recovery has been redirected or repurposed toward green projects in various countries.

Governments have sought to align economic recovery efforts with climate and sustainability goals, often under the banner of a “green recovery”.

The European Union’s €750 billion Next Generation EU recovery package, launched in response to the pandemic, earmarked approximately 30 per cent of its funds – around €225 billion – for climate-related initiatives under the European Green Deal.

This included investments in renewable energy, energy efficiency and sustainable transport, often framed as a dual response to economic recovery and environmental goals.

Secret contracts between the European Commission and “green” NGOs were reportedly part of an alleged “shadow lobbying scheme”, according to a Dutch newspaper. https://t.co/cAWxagk9TA

— Brussels Signal (@brusselssignal) January 23, 2025

In the US, the Biden-Harris administration leveraged Covid-related legislation, such as the Inflation Reduction Act (IRA) of 2022, to channel funds into climate initiatives.

Under the new administration of US President Donald Trump, there has been a shift away from these climate policies, forcing hedge funds and pension funds to rethink their strategies.

On March 4, hedge-fund founder Nishant Gupta declared the energy transition “dead for now” in a Bloomberg article.

“The fundamentals are very poor,” he said.

In 2024, both BlackRock and Vanguard significantly scaled back their public commitment to ESG initiatives, particularly those tied to aggressive climate goals, citing legal risks and client interests.

By December 2024, BlackRock also exited the Net Zero Asset Managers initiative, a coalition it had joined in 2021 to align portfolios with net-zero goals.

This came amid growing pressure from Republican-led US states including Texas which sued BlackRock, Vanguard and State Street in November 2024, alleging their ESG efforts manipulated energy markets and raised consumer costs.

BlackRock’s 2024 proxy voting further reflected this pivot. It supported just 4 per cent of environmental and social (E+S) shareholder proposals, down from 7 per cent in 2023 and a stark drop from 47 per cent in 2021.

Blackrock CEO Larry Fink’s 2024 letter to investors avoided the term “ESG” entirely, focusing instead on energy pragmatism and infrastructure.

Both Blackrock and Vanguard faced a backdrop of rising anti-ESG sentiment in the US, especially from Conservative lawmakers who branded it “woke capitalism”.

BP has announced it will raise spending on oil and gas to $10 billion a year – and drop its interests in “green” energy. https://t.co/hNKJJonSmx

— Brussels Signal (@brusselssignal) March 3, 2025