Former German Greens economics minister Robert Habeck is facing heavy criticism from the German auditors over having granted a €600 million loan to Northvolt while not sufficiently assessing the risks.

In a 50-page-plus confidential report, the Federal Court of Audit (BRH) raised serious accusations against Habeck, newspaper Bild reported on June 17.

Habeck was “careless” in giving €600 million of taxpayers’ money in a state loan to the battery manufacturer, the auditors said.

The money was supposed to be used for the construction of a battery plant in the country but with Nothvolt now bankrupt, taxpayers were facing the losses on the loans.

In the report, the auditors said Habeck “systematically underestimated the risks for the federal government”.

A corresponding report by the auditing company PwC (now also classified as secret) also did not correctly show the risks, Bild reported.

It was not apparent that the Ministry of Economics “questioned central assumptions of the company’s success”, according to BRH.

Habeck’s ministry has “de facto assessed the risks of the State loan alone”. There was no “multiple eyes principle”.

This meant it was Habecks’ ministry that made the ultimate decision, ignoring the Ministry of Finance, which was led by Christian Linder at the time, of the Liberal Party.

A report by Swedish economic researcher Jonas Grafström has criticised the EU’s industrial policy, citing Northvolt’s collapse as evidence of flawed taxpayer-funded investments. https://t.co/t1NwtBwJEd

— Brussels Signal (@brusselssignal) December 11, 2024

According to BRH, the economics ministry had “insufficiently identified and assessed material risks of the convertible bond”.

“Instead, it acted largely according to the principle of hope.”

The auditors also added that Habeck and his ministry failed in “the duty to keep records properly”, leading to essential decision-making regarding the loan not being documented.

This created a lack of “traceability and external control”.

That was particularly the case regarding video conferences with other experts such as, for example, those of PwC.

“These violations are particularly serious due to the political and financial importance of the present case,” the BRH auditors wrote.

Christian Democratic Union (CDU) MP Andreas Mattfeldt said: “One gets the impression that not only gross negligence is at play here. It seems that it was presumably intentional.”

He described the BRH report as “explosive”.

The Northvolt debacle “is one of the major financial affairs of the republic”, he added.

Alternative for Germany (AfD) party’s budget specialist Michael Espendiller noted what he said was a glaring difference between what the government demanded from the people and to what standards it holds itself.

“It cannot be that citizens in Germany are subject to receipt obligations and years of retention obligations for tax documents but essential decision-making steps and decision-making bases and information about background discussions on the planned convertible bond [the Northvolt loan] were not documented at all in the BMWE [ministry of economics].

“Millions of euros of taxpayer money wasted, conflicts of interest, sloppy record keeping, and government action without adequate risk assessment – what Robert Habeck did during his time as Minister of Economic Affairs in the Northvolt case not only makes Germany look like just another banana republic but also raises serious questions about the possible criminal conduct of those involved,” Espendiller added.

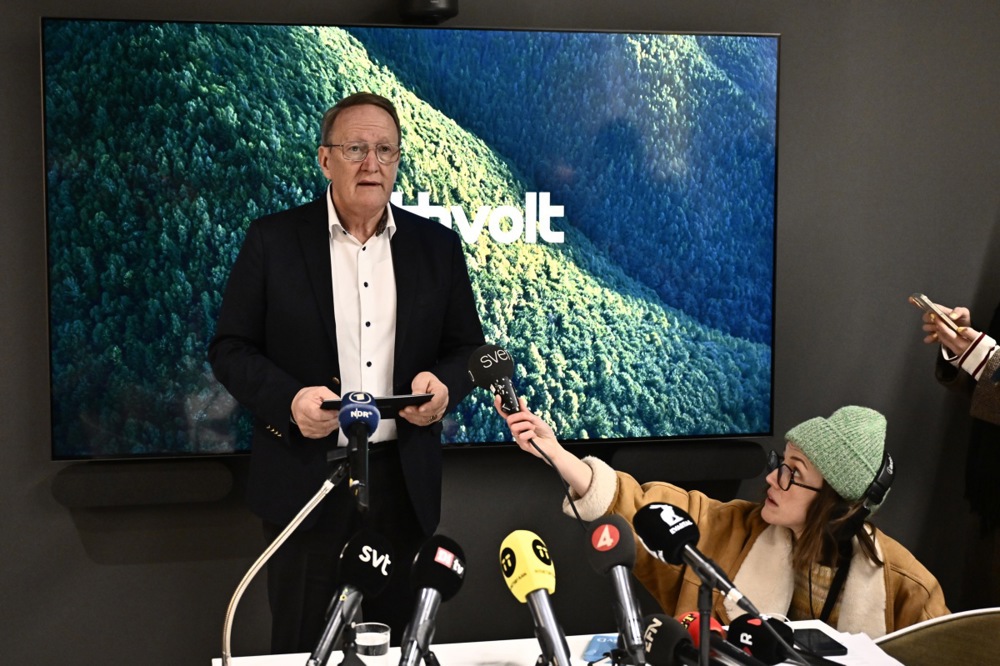

Northvolt was constructing a factory in Heide, Schleswig-Holstein, but as the company filed for bankruptcy in Sweden earlier this year, it was unclear what the future held for the site in Germany.

The economics ministry and the finance ministry argued that Northvolt’s insolvency was largely triggered by external factors and that auditing took place independently.

Swedish electric battery battery maker Northvolt has filed for bankruptcy in Sweden after it was unable to find money to pay its taxes. https://t.co/Al2OcIcCpR

— Brussels Signal (@brusselssignal) March 13, 2025