Spain’s grid operator, Red Eléctrica (REE), has issued a fresh alert to the National Commission on Markets and Competition (CNMC) about “abrupt voltage variations” detected in the national electricity system over the past two weeks.

According to REE yesterday, these fluctuations could trigger automatic disconnections of demand or generation units, raising the risk of another large-scale blackout similar to the one that crippled most of Spain and Portugal on April 28, 2025.

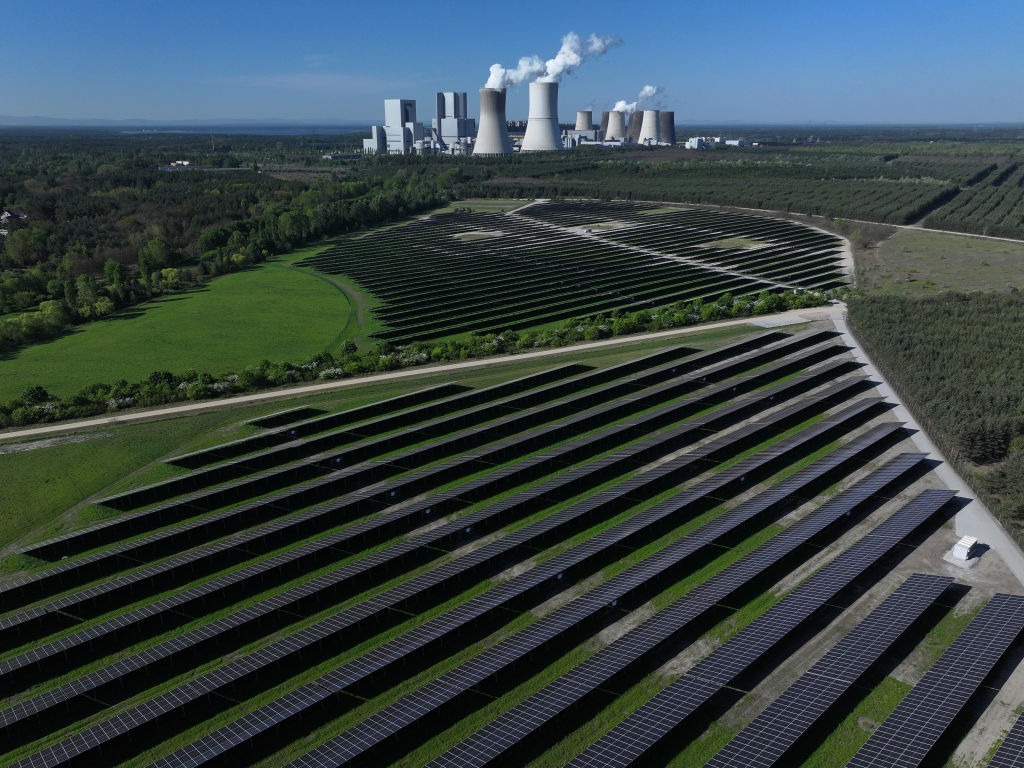

Since that incident, the Spanish Government has increased its reliance on gas to stabilise the grid and limited the share of renewables entering the system. Those measures, though, are no longer sufficient, REE warns.

“The system operator highlights the observance in the last two weeks of sudden variations in voltage in the Spanish peninsular electricity system, such that they may have an impact on the security of supply if the proposed changes are not implemented”, the CNMC said in a document released yesterday.

It said Red Eléctrica has requested urgent changes in several system operation procedures, attributing the recent instability to the rapid expansion of power-electronics-based generation such as renewables, the geographic concentration of generation and inadequate continuous voltage regulation from certain plants.

While the CNMC’s explanation does not explicitly names renewables as the core issue, it did point to increasing variation in energy production and technologies that “do not regulate voltage continuously”.

The company is requesting urgent, temporary changes to four operational procedures for at least 30 days, with possible extensions, to enhance grid stability.

REE emphasised no immediate supply risk exists but said proactive steps are needed amid low demand and high renewable output.

The protocol changes were aimed at “mitigating sudden voltage variations” that Red Eléctrica itself has linked to “sudden changes in the programme, in particular, in renewable generation”, as well as with too long response times of conventional plants in which voltage control falls.

On October 6, newspaper El Mundo asked Red Eléctrica about recent voltage anomalies in the system. Sources at the operator denied any problems.

The State-run company has continued to claim that its management of renewable production “was not the problem” but its call for urgent help proves to many the current system is not adequate to negate the effect of renewables on the stability of the network.

“According to the information provided by the system operator, the rapid voltage variations recorded in the last two weeks, even if the voltages are always within the established margins, can potentially trigger disconnections of demand and/or generation that end up destabilising the electricity system,” the CNMC reported.

Those huge disconnections were what led to the April mega-blackout that put Spain and Portugal in the dark.

Spain blackout:

In first 80 seconds, all generation losses were solar and wind

In those 80 seconds, Spain lost 10% or 2.5GW of its 25GW

But sure, solar and wind didn't cause the blackout

(first gas-fired power plant dropped out right after chart ends at 12:33:20:100, 12a… https://t.co/ki6UO4j391 pic.twitter.com/4h5yFVnYEM

— Bjorn Lomborg (@BjornLomborg) October 7, 2025

Red Eléctrica admitted in its alert that the “high concentration in certain parts of the country” of renewables caused the growing instability.

At the beginning of October, the Renewable Energy Control Centre (Cecre) warned photovoltaic and wind-power companies throughout Spain to restrict their activities and lower energy production to ensure grid stability.

Weather conditions were very similar to those during the mega-blackout.

Red Eléctrica noted that energy systems with continuous voltage control lacked response speed to react on current swings on the grid.

After receiving the warning, the supervisory body immediately acted and sought to modify the operating protocols, some of which have been in force for more than two decades.

Despite all this, Madrid continues to deny an over-reliance on renewables was the cause of the problem six months ago.

Analysts warn that the new emergency measures could reduce market competitiveness and raise consumer costs, already estimated to exceed €1 billion in 2025 due to related system reinforcements.

While Spain and Portugal are slowly recovering from the electricity blackout that put both countries to a standstill, experts have been pointing out that renewable energy might be the main cause of the problem. https://t.co/NdHa9tBpeB

— Brussels Signal (@brusselssignal) April 29, 2025