European Central Bank (ECB) President Christine Lagarde has warned that the collapse of French Prime Minister François Bayrou’s government would pose a “worrying risk” to France and, by extension, to the wider eurozone.

She warned that political turmoil in any eurozone country “weighs on markets” in an interview with Radio Classique on September 1.

“All risks of government collapse in any eurozone country are worrying,” she said.

“Political developments, and the emergence of political risks, have an obvious impact on the economy, on how financial markets assess country risk, and are therefore a concern for us,” she added.

The ECB chief was, though, more reassuring about the situation of the French banking system, stating: “It is better than it was during the last financial crisis, it is well structured, supervised, with responsible players.”

She also pointed out that the markets “always assess “country risk. And that France’s country risk has “increased in recent days”.

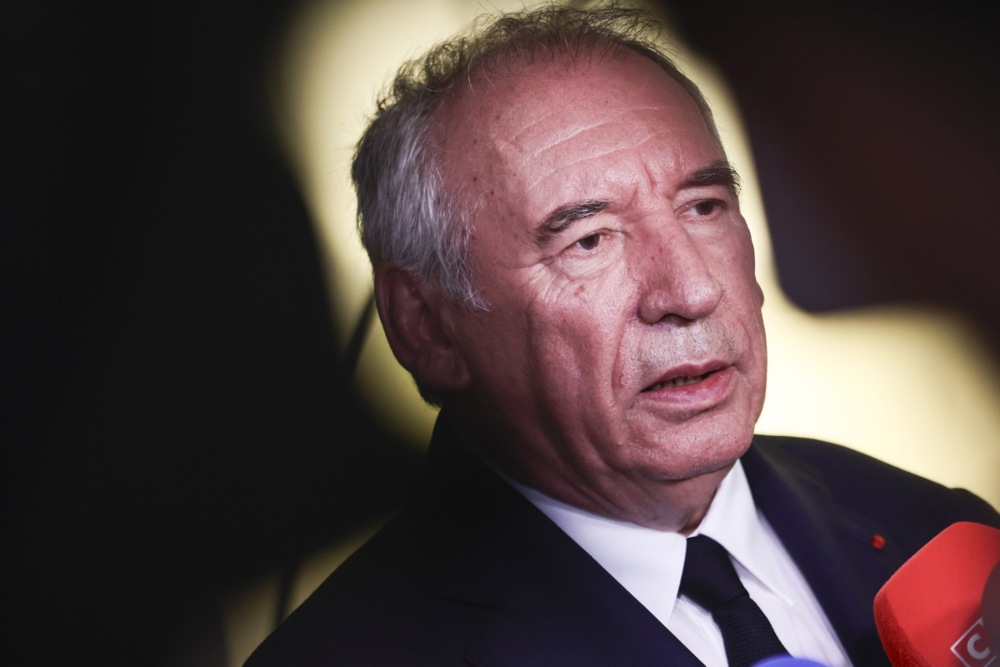

Her comments came after Bayrou, who has struggled for months to pass his government’s austerity-driven debt reduction programme, on August 25 called for a confidence vote.

Following that, opposition parties from both the Left and Right have vowed to bring his government down.

Lagarde also reminded eurozone governments of the need to maintain sustainable public finances.

“I believe that for all the countries in the eurozone, it is absolutely vital to have a viable debt, a sustainable debt,” she said.

France does not currently meet this standard. Its debt stood at €3.35 trillion at the end of the first quarter of 2025, representing 114 per cent of GDP.

This leaves the country among the eurozone’s most indebted nations, trailing only Greece and Italy.

For 50 years, Paris has consistently spent more than it earned, feeding its now chronic budget deficit.

French Prime Minister François Bayrou said the destiny of France was at stake in a forthcoming confidence vote, which he called to resolve a budget standoff but which he is expected to lose. https://t.co/e8GsaXbNKB

— Brussels Signal (@brusselssignal) September 1, 2025